Smart Tips About What Is Bill Format

Understanding the Basics of a Bill Format

1. What Exactly Are We Talking About?

Okay, so let's talk bills. Not the duck-billed kind, but the kind that show up in your mailbox (or more likely, your inbox these days) demanding payment. A bill format, simply put, is the standardized way these documents are presented. Think of it as a blueprint for how information like the amount due, due date, and services rendered are laid out. It helps keep things organized and, hopefully, easy to understand. Because let's be honest, deciphering some bills feels like trying to read ancient hieroglyphics.

Without a consistent format, chaos would reign supreme. Imagine every company sending out bills in completely different styles — some with handwritten notes, others with cryptic abbreviations, and maybe one or two that arrive on a scroll tied with a ribbon. Madness! Standardized bill formats ensure we can quickly find the information we need, avoiding late fees and potential blood pressure spikes. Efficiency is key, my friend!

Now, you might be thinking, "Why should I care about the format? As long as I know how much I owe, I'm good." And that's a fair point. But understanding the different components of a bill format can help you identify errors, track your spending, and even spot potential fraud. Plus, it makes you look super savvy when you call customer service with a specific question about a charge listed on line item 7B.

Think of it like this: understanding bill formats is like learning a secret language. Once you know the lingo, you can navigate the world of invoices and statements with confidence. No more scratching your head in confusion — you'll be a bill-deciphering ninja! And who wouldn't want that superpower?

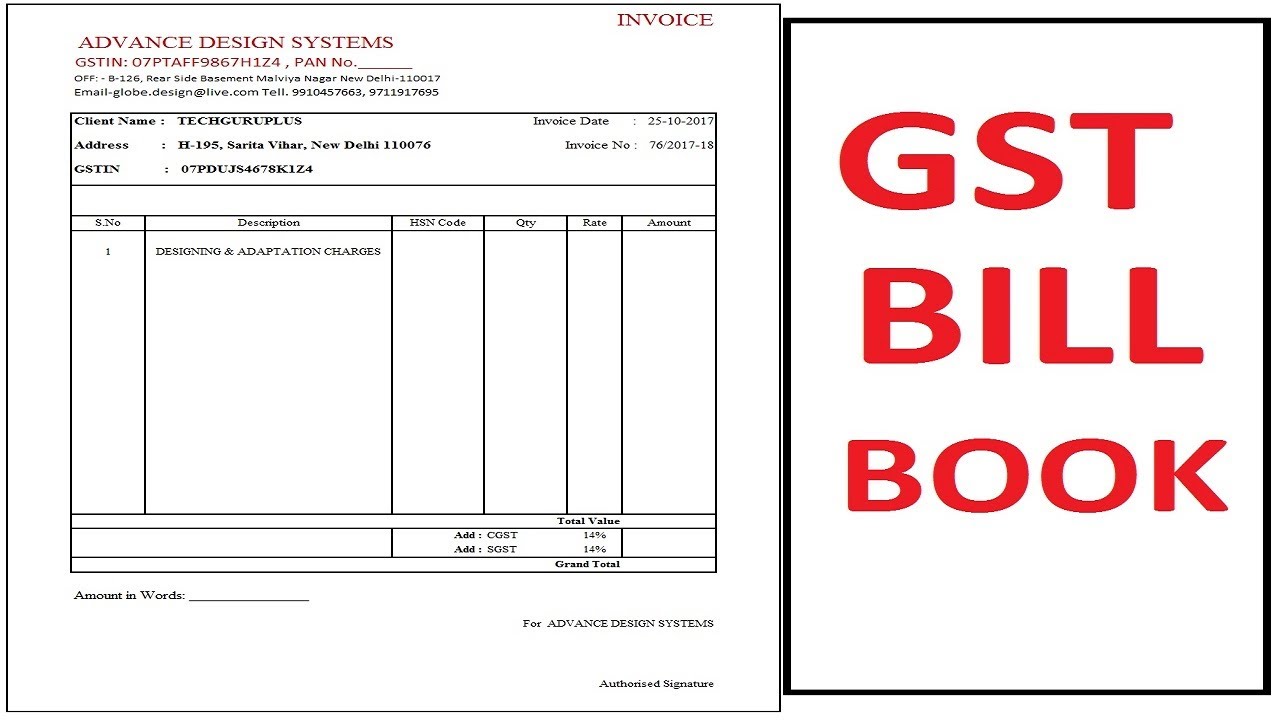

Normal Bill Format In Word New Invoice

Key Components of a Standard Bill Format

2. Decoding the Jargon

So, what are the critical components that make up a typical bill format? Well, there are a few standard elements you'll find across most bills, regardless of the industry or service provider. Let's break them down one by one, shall we? Think of it as "Bill Anatomy 101".

First up, you've got the obvious stuff: the biller's information (name, address, contact details), your information (name, account number), and the billing date. This is like the heading of a letter — it tells you who sent it, who it's for, and when it was sent. Then comes the all-important summary of charges, which details exactly what you're being billed for. This might include a breakdown of services, usage fees, taxes, and any discounts applied. Keep an eye on this section are you sure you ordered three premium channels you don't even watch?

Next, you'll usually find the total amount due and the due date. These are the critical numbers, the ones that determine whether you stay in the good graces of your creditors. Don't miss that due date! Late payments can lead to penalties and, eventually, a sad face from your credit score. Some bills will also include a payment stub or instructions on how to pay online, by mail, or in person. The more convenient, the better, right?

Finally, most bills will have a section for customer service information, including a phone number, email address, and sometimes even a website URL. This is your lifeline if you have questions, disputes, or just need to vent about that mysterious "regulatory recovery fee." In addition, there may be some fine print or legal disclaimers. Lets be honest, nobody reads that part. But hey, its there.

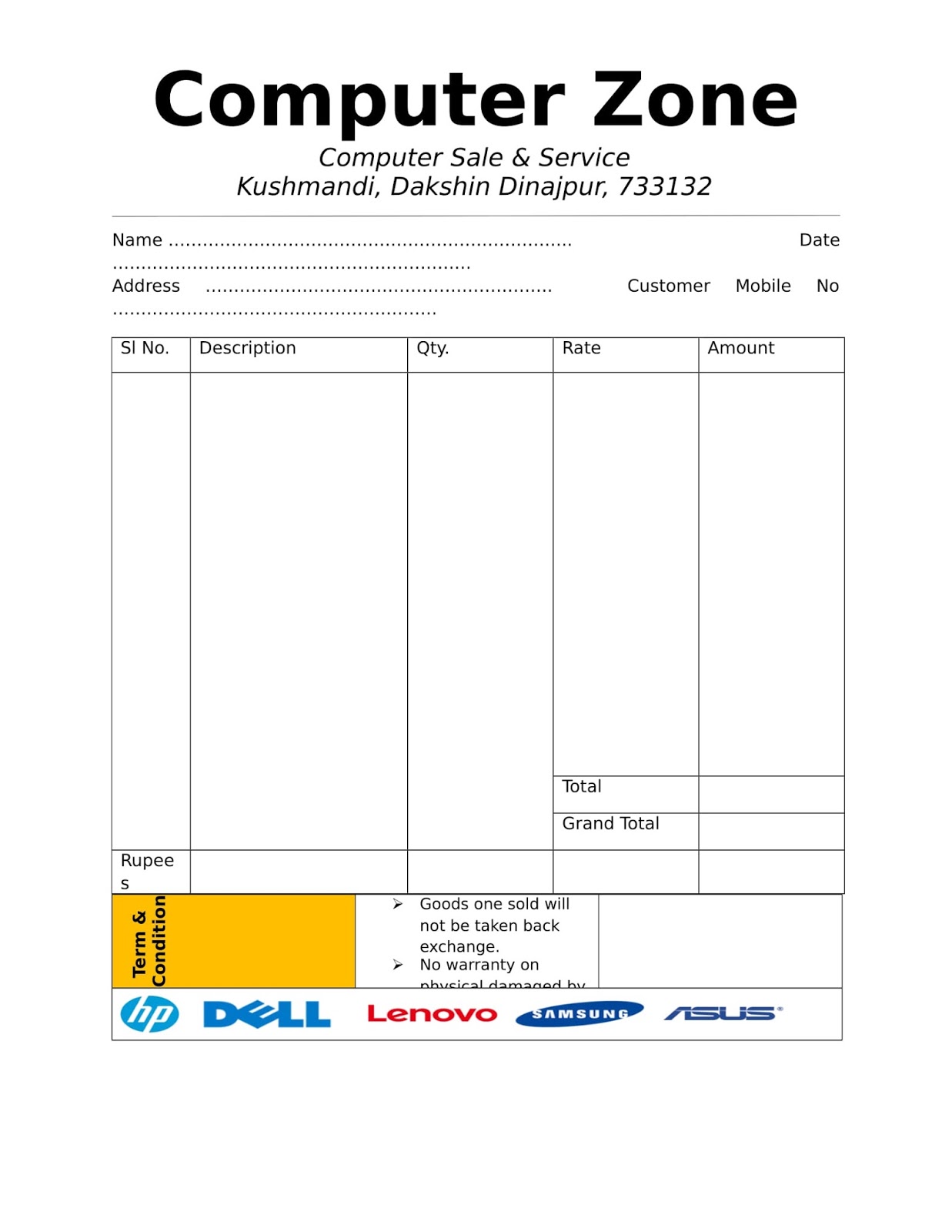

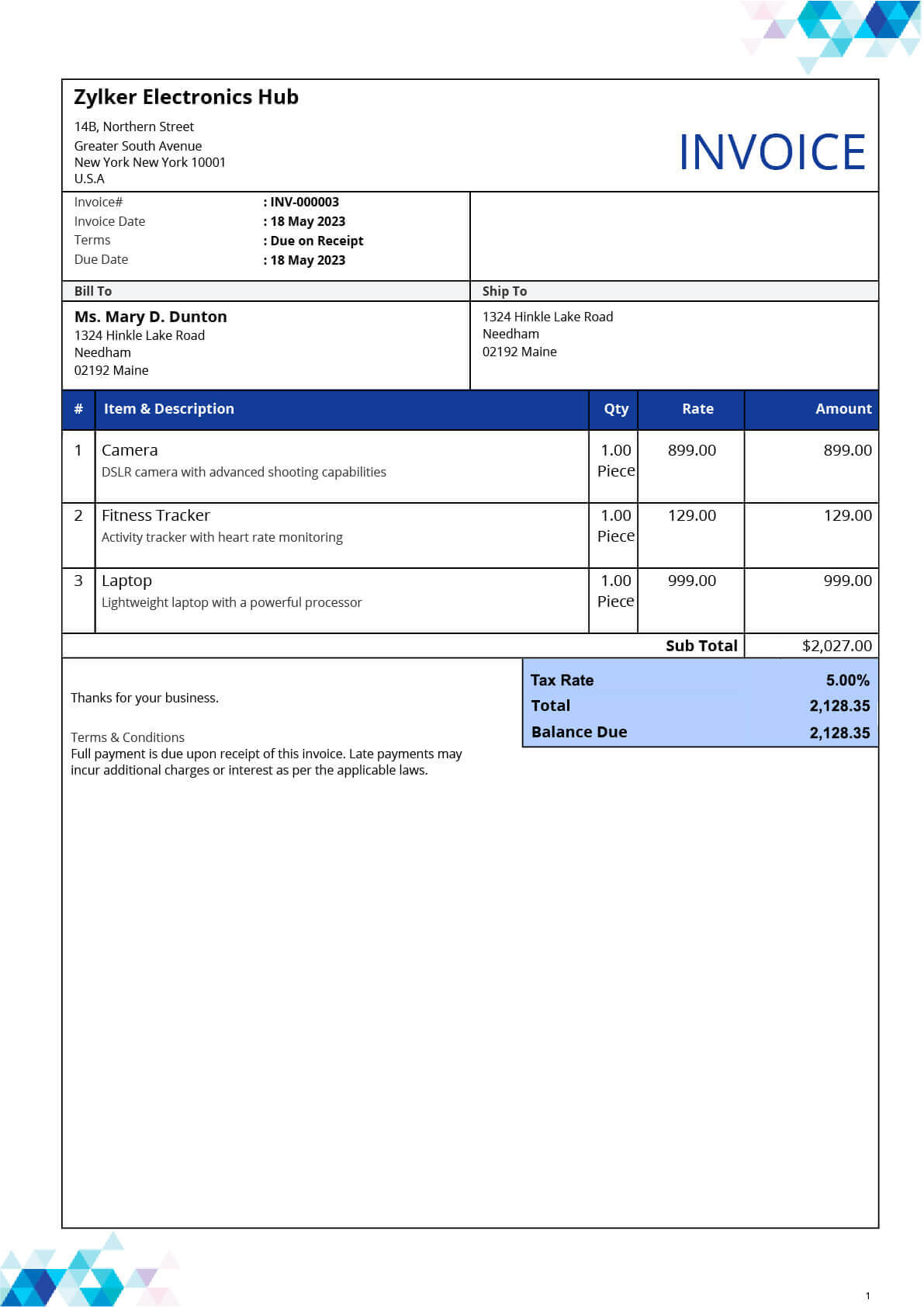

Invoice Format In Word Simple Free Template

Different Types of Bill Formats

3. One Size Doesn't Fit All

While there are general guidelines for bill formats, not all bills are created equal. Different industries and companies may use slightly different layouts or include additional information based on their specific needs. For example, a medical bill might include detailed procedure codes and diagnosis codes, while a utility bill might focus on usage data and energy consumption. Tailoring the format ensures relevant details are front and center.

Think about your credit card statement versus your phone bill. The credit card statement will probably highlight your minimum payment due, available credit, and transaction history. Your phone bill, on the other hand, will likely emphasize data usage, call logs, and any overage charges. These differences reflect the unique nature of each service.

Even within the same industry, you might see variations in bill formats. Some companies may prefer a minimalist design with only the essential information, while others might opt for a more detailed breakdown with charts, graphs, and personalized messages. The goal is to present the information in a clear and accessible way that meets the needs of their customers.

The rise of digital billing has also led to new types of bill formats. Online statements often offer interactive features, such as the ability to view past bills, track spending trends, and even set up automatic payments. And some companies are experimenting with mobile-friendly bill formats that are optimized for viewing on smartphones and tablets. Talk about convenience at your fingertips!

Travel Agent Bill Format In Excel

Why Understanding Bill Format Matters

4. Beyond the Numbers

So, why should you bother understanding bill formats? Whats in it for you? Well, for starters, it can save you money. By carefully reviewing your bills, you can identify errors, overcharges, or even fraudulent activity. Catching a mistake early can prevent you from paying for something you didn't actually use or authorize. Imagine finding out you have been paying a subscription for the last five years that you completely forgot about.

Furthermore, understanding your bills can help you budget and manage your finances more effectively. By tracking your spending habits and identifying areas where you can cut back, you can take control of your money and achieve your financial goals. Knowledge is power, especially when it comes to your bank account!

Another benefit of understanding bill formats is that it can improve your communication with customer service representatives. If you have a question or dispute about a charge, you'll be able to explain your issue more clearly and concisely if you understand the components of the bill. This can lead to faster resolutions and less frustration.

Finally, let's be honest, knowing how to read a bill just makes you feel more competent and informed. It's like unlocking a secret skill that allows you to navigate the world of finance with confidence. No more feeling intimidated by confusing statements — you're in charge! And that's a feeling worth investing in. It's all about taking that control of your finance!

42 Bill Book Format In Coreldraw Cash Memo Corel Draw Vrogue.co

Tips for Deciphering and Managing Your Bills

5. Becoming a Bill-Reading Pro

Alright, so you're ready to tackle those bills like a pro. But where do you start? Here are a few tips to help you decipher and manage your bills effectively. First, always read your bills carefully, line by line. Don't just glance at the total amount due — take the time to review each charge and make sure it's accurate. It may seem tedious, but even a small error can add up over time.

Next, keep your bills organized. Whether you prefer paper copies or digital versions, create a system that allows you to easily access and review your bills when needed. You can use folders, binders, or even a cloud-based storage solution like Google Drive or Dropbox. Whatever works for you, just make sure it's consistent.

Don't be afraid to ask questions. If you don't understand a charge or if you suspect an error, contact the company's customer service department right away. The sooner you address the issue, the better. And remember to be polite and professional — even if you're frustrated.

Finally, consider setting up automatic payments for your recurring bills. This can help you avoid late fees and improve your credit score. Just make sure you have enough money in your account to cover the payments each month. Its a simple step that can save you time and stress in the long run.